Electric Cars in North America: 2025 Market Trends, Sales Growth, and Key Insights to Share

The electric vehicle revolution is no longer a distant dream—it’s here, and it’s charging ahead fast. In 2025, electric cars in North America are experiencing unprecedented growth driven by technological innovation, government support, and shifting consumer preferences. From massive factory expansions to all-new vehicle launches, North America is becoming a global leader in EV production, sales, and innovation.

In this article, we explore the latest trends, key manufacturers, infrastructure developments, consumer behavior, and future forecasts that define the electric car market in the U.S., Canada, and Mexico.

EV Sales and Adoption Rates Are Soaring

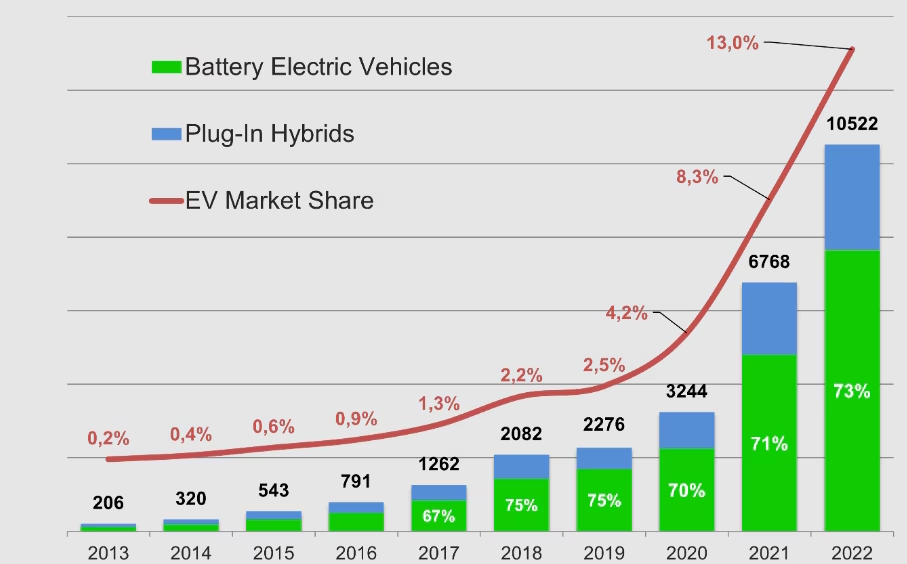

The EV boom across North America is fueled by both regulatory pressure and rising demand. In 2024, electric vehicles represented approximately 12% of all new car sales in the United States, up from just 2.5% five years earlier. Canada reached a national average of 10.5% EV adoption, while some provinces like British Columbia and Quebec exceeded 20%.

Mexico, traditionally slower to adopt EVs due to infrastructure gaps, is catching up thanks to government-backed production initiatives and increased affordability. With more EVs made in North America than ever before, prices are stabilizing and availability is improving, making it easier for everyday drivers to make the switch.

Key Players: North American EV Manufacturing Powerhouses

A major reason for the rapid rise of electric cars in North America is the local production capacity of major automakers. Here’s who’s leading the charge:

- Tesla continues to dominate the EV landscape, with Gigafactories in Texas and Nevada producing the Model Y, Model 3, and soon, the Cybertruck.

- Ford is manufacturing the F-150 Lightning in Michigan and the Mustang Mach-E in Mexico, signaling a firm commitment to all-electric future offerings.

- General Motors (GM) has launched vehicles like the Chevy Blazer EV and Silverado EV, all built on its proprietary Ultium platform.

- Rivian builds its adventure-ready R1T and R1S in Illinois, with a second facility coming to Georgia.

- Lucid Motors manufactures the high-performance Lucid Air at its Arizona facility, aiming to capture the luxury EV segment.

Meanwhile, international players like Volkswagen, BMW, and BYD are ramping up production in Mexico to meet U.S. and Canadian demand, benefiting from trade-friendly policies under USMCA.

Government Incentives and Infrastructure Investment

Another key driver of adoption is the wealth of government incentives available to both consumers and manufacturers.

United States:

- The Inflation Reduction Act (IRA) provides up to $7,500 in federal tax credits for qualifying vehicles. New rules emphasize North American assembly and battery sourcing, pushing automakers to build locally.

- The NEVI program is investing billions to create a national network of 500,000 EV charging stations.

Canada:

- The iZEV program offers up to CAD $5,000 in federal rebates, with additional incentives available in provinces like Quebec ($7,000) and British Columbia.

- Canada has mandated that 100% of new light-duty vehicles be zero-emission by 2035.

Mexico:

- While Mexico doesn’t yet offer federal tax rebates for EVs, it provides attractive incentives for automakers, including land grants, tax benefits, and fast-tracked permitting for EV manufacturing.

These policies are critical in building a robust ecosystem for electric cars in North America, ensuring both supply and demand continue to rise.

Charging Infrastructure and Battery Innovation

As more electric cars hit the roads, the need for charging infrastructure is becoming a top priority.

- Tesla’s Supercharger network remains the most widespread and fastest-charging system in North America, now opening access to other EV brands.

- ChargePoint, Electrify America, and EVgo continue expanding urban and highway networks.

- Home charging incentives and Level 2 installation rebates are growing, especially in Canada and select U.S. states.

On the battery front, breakthroughs in solid-state technology, lithium-iron phosphate (LFP) chemistry, and domestic battery production are driving range improvements and cost reductions. Companies like Panasonic, LG Energy Solution, and CATL are opening new gigafactories across the U.S. and Canada.

Consumer Trends, Price Sensitivity, and Barriers

The average North American EV buyer in 2025 is more informed, environmentally conscious, and financially savvy. Still, several considerations influence buying decisions:

- Affordability remains a top concern. Though more EVs now fall under $40,000, upfront costs are still higher than gas vehicles for many families.

- Range anxiety persists but is easing thanks to longer-range models and better charging infrastructure.

- Used EV markets are growing, offering more affordable entry points.

- Leasing has increased in popularity, especially for consumers who want to access federal incentives on vehicles that might not qualify when purchased.

Overall, trust in electric cars in North America is growing rapidly as consumers get more exposure, options, and information.

What to Expect: 2025–2030 Forecast

So what’s ahead for the North American EV landscape?

- EV sales could reach 40% of all new vehicle sales by 2030 in the U.S., according to the EPA.

- Canada is expected to surpass 60% zero-emission vehicle sales by 2030.

- Mexico will become a global hub for EV production, with increased focus on export-ready models and public EV fleet conversion.

- More than 100 EV models are expected to be available in North America by 2027, across every segment—sedans, crossovers, pickups, and vans.

- Vehicle-to-grid (V2G) technologies and smart charging networks will integrate EVs more deeply with the energy grid.

With innovation accelerating and infrastructure catching up, the next five years will define the long-term future of electric cars in North America.

Final Thoughts

The growth of electric cars in North America is a defining story of this decade—blending sustainability, economic opportunity, and technological progress. With major automakers scaling up local production, governments providing generous incentives, and consumers embracing the shift, the future is not just electric—it’s being built right here at home.